What is an ESOP?

An Employee Stock Ownership Plan (ESOP) is an alternative to selling your business which can be used as a financial incentive to reward your employees, and a tool to plan succession for retiring owners.

An ESOP rewards employees with shares in the company they work for, giving them an extra financial incentive to help the company succeed. These shares are often distributed based on how long an employee has worked for the company, or could be tied to other goals and targets.

How does an ESOP work?

When a company signs up to an ESOP, the ESOP facilitator will enlist an independent and government-audited third party, called a fiduciary, to complete a fair market valuation of the business. The ESOP facilitator will then go to their network of ESOP lenders to raise this finance.

Lenders will only provide up to 2.5x a company’s EBITDA, and if the fair market value of the company exceeds this 2.5x, the shareholders will hold a ‘note’ for their remaining shares. The ESOP facilitator will then return to their preferred lenders for a second round of financing at a later date (usually three to five years) to pay off the remaining note.

Existing shareholders in the business do not have to sell their shares during this transaction – they can hold on to as many or as little as they like.

The business owner does not have to cede control of the company during this transaction, either. Although ESOPs are a popular option with business owners who are thinking of retiring or succession planning, many choose to stay in control of the company after joining the ESOP.

Do employees have to pay for an ESOP?

No. Employees do not pay a single cent to participate in an ESOP, but can benefit financially from them.

Are ESOPs good for employees?

Yes. ESOPs provide an incentive for employees to meet their goals and help a company succeed, since they are renumerated based on the company’s performance. They also provide an incentive for employees to stay loyal to the company they work for over time.

ESOPs can provide employees who have worked for the same company for many years with significant retirement packages – even if their role remained a fairly entry-level one.

When is an ESOP beneficial?

ESOPs are a great option for companies that want to reward the loyalty of their employees, and hold on to those employees long-term. They are also a good fit for business owners who are thinking of retiring, and want to create an exit strategy that will protect the jobs and security of their employees. With an ESOP, there is no risk that a new owner buying your business will let staff go.

Another benefit is eliminating the need to find a buyer for your business. Raising the finance from ESOP lenders can take place as quickly as 90-120 days, which could be a bonus for business owners who are looking to hand over responsibility of their business quickly.

Do I qualify for an ESOP?

To qualify for an ESOP, your company must have $1m of 12-month trailing EBITDA, and at least 15 W2 employees who are working 20 hours or more per week (or 1,000 hours annually).

How is an ESOP paid out?

Employees at a company enrolled in an ESOP will receive the value of their accumulated shares when they leave the company, retire, or are terminated. Generally speaking, employees are not able to cash out of their ESOP before then – although the terms of each ESOP may differ.

Are there tax benefits with an ESOP?

Yes. Entering into an ESOP means you can indefinitely defer paying capital gains tax that you would usually pay in a third-party sale. You will use the money that would normally be used to pay this tax in order to pay back the ESOP lenders.

What kinds of companies have ESOPs?

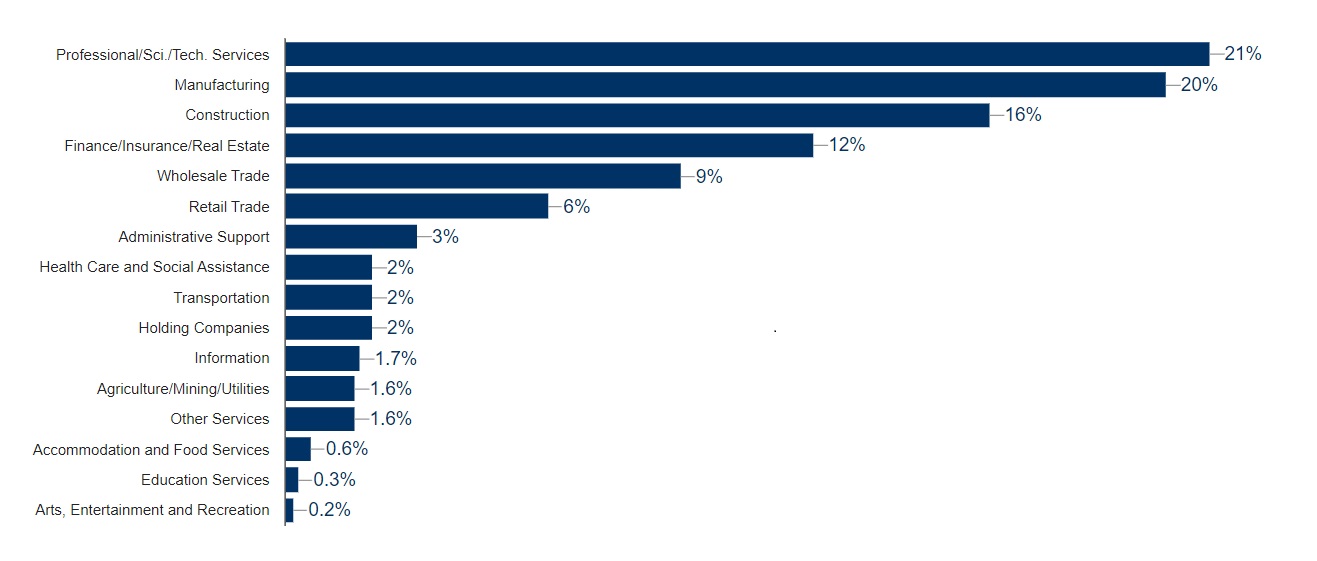

ESOPs are represented across a wide variety of industries, and can be beneficial for all kinds of businesses. The following graph, put together by the National Center for Employee Ownership, shows the percentage of companies in the US which are ESOPs, by sector:

Where can I enroll in an ESOP?

If you’re interested in finding out more about ESOPs, fill in the form at the bottom of this page. We fill refer you to our trusted ESOP partners, who can walk you through the process and demonstrate how they could benefit your business.

An example of ESOPs in action

Getting to grips with how an ESOP works might be easier using an example, and some real-world numbers.

Let’s say that Company X wants to join an ESOP. It has a trailing 12-month EBITDA of $2m, and its fair market valuation comes in at 5x that, $10m.

In the first round of financing, ESOP lenders would provide Company X with $5m (2.5x it’s TTM EBITDA). Closing could take place as quickly as 90-120 days. At the end of this time period, shareholders would receive $5m and provide the ESOP facilitator with a note for their remaining $5m. This is converted into synthetic equity known as Shareholder Seller Financing Warranties.

Company X now becomes a tax-free entity, and uses the revenue it previously paid in taxes to pay back the ESOP lenders.

In three to five years, the ESOP facilitator would then go back to the credit market for a second round of financing to pay off the remaining Shareholders Warrants (or as many as the shareholder wants to sell). These will usually have increased in value, sometimes by 30% to 50%. Additional visits to the credit market can take place as needed.

Common Misconceptions About ESOPs

Many business owners will have heard of ESOPs – perhaps one of their clients has joined one – but there are still a lot of misconceptions about how they work. Here are some of the most common ones, debunked.

• Selling shareholders will lose control to employees. This is not the case – the business owner and shareholders can retain as much control of the company as they wish to.

• Management or employees will have to fund the purchase. They will not have to pay a single cent. The ESOP is funded by the company, not by its employees.

• The company must be a particular entity type. Companies of all shapes and sizes can join ESOPs, as long as they meet the requirements mentioned above.

• Employees will have access to sensitive company financial information. This is not true – company management can maintain privacy of sensitive information.

• Sellers will not receive a fair purchase price. You will always receive fair market value for your business in an ESOP transaction. This value will be determined by a government-audited third party called a fiduciary, guaranteeing its accuracy.

• You need a large payroll. Joining an ESOP only requires you to have at least 15 W2 employees who are working 20 hours or more per week (or 1,000 hours annually).